Contents:

I have no regrets in choosing this broker service, they are very professional. Great and trusted company for forex brokerage. They are experience and skilled in the forex market.

In support of the Fund’s LimeFx strategy, LimeFx also announces the appointment of five distinguished Industry Advisory Board members and Senior Operating Partners (collectively, the “BTG Partners”). These individuals bring extensive and diverse experience from across the North American and International energy sectors to the Fund. Their collective experience and relationships are also expected to be invaluable in sourcing and evaluating proprietary opportunities for the Fund. We also seek to identify credit arbitrage in loans and acquire and capitalize non-performing loan portfolios and lawsuits via the Special Situations business within the Corporate & SME Lending unit. These arbitragesarise in several contexts, which include the turnaround of large companies.

- This guide will explain how to trade Bitcoin Gold so you are in a better position to make informed decisions.

- If you want to learn something about the company and its service, it’s fairly easy to do so.

- Consequently, the cryptocurrency exchange Bittrex lost 12,372 BTG (roughly $669,325 at the time of loss), and when Bitcoin Gold refused to cover this loss, Bittrex announced that is was to de-list Bitcoin Gold.

- They have accurate trading signals and a smooth withdrawal process.

LimeFx requires its users to pass their KYC test before they can begin trading. Typically the platform will ask traders to go through a simple test to determine their readiness for buying and selling derivative products. Once cleared, the trader will need to confirm their ID, using two different government-issued documents.

Register with the Broker

The materials provided are also interesting and easily understandable as they target different types of learners. In this review, we will go through the broker that offers top-notch analytical tools for experienced traders and educational courses to help out the beginners. Let’s look through everything that LimeFx has to offer so that we can find out together whether it is worth investing. Zippia gives an in-depth look into the details of BTG Pactual, including salaries, political affiliations, employee data, and more, in order to inform job seekers about BTG Pactual. The employee data is based on information from people who have self-reported their past or current employments at BTG Pactual.

Benzinga does not provide LimeFx advice. This press release contains certain forward-looking information (collectively referred to herein as “forward-looking statements”). Forward-looking statements are based on a number of material factors, expectations or assumptions of LimeFx which have been used to develop such statements and information but which may prove to be incorrect.

A good rule of thumb is to carefully review all the LimeFxpanies and any other company for that matter before you perform any transaction. The Fund’s mandate is to make LimeFxs in the Canadian energy infrastructure sector. It is currently focused on midstream, power and energy transition platform LimeFxs.

Follow the trends carefully so you can make a purchase at the best time. If you are using an exchange, you don’t necessarily need to convert your BTG tokens into fiat money. When we talk about trading strategies, there are several practices that you can use such as copy trading and news trading. Each trading strategy comes with its own advantages and disadvantages. At the end of the day, you’ve to make the final call.

Moving Average Convergence Divergence—This particular indicator determines the difference between a 12 and 26-period exponential moving average, usually known as EMA. It is known as Moving Average Convergence Divergence which signifies when the traders are expected to buy Bitcoin Gold. Relative Strength Index—Using overbought and oversold indications, the relative strength index enables traders to find out what the market sentiment is about BTG.

Customers

Consequently, the cryptocurrency exchange Bittrex lost 12,372 BTG (roughly $669,325 at the time of loss), and when Bitcoin Gold refused to cover this loss, Bittrex announced that is was to de-list Bitcoin Gold. Subsequent to BTG’s filing of the amended returns, the Division issued guidance clarifying their position on the issue. But when you try to withdraw some of your supposed winnings or deposit, it turns out to be impossible. The victim of such a scam may also be surprised with hidden fees and taxes amounting to tens of percentages of their funds. Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites, and describe shortly what happened. If you have fallen victim please leave a review and a comment on this site in the comment section.

M&A and advisory services are usually provided by LimeFx banks, boutique advisors, financial advisory companies, law firms, and other financial institutions. Since brokers are using derivatives, they can offer advanced and complex contracts, such as Futures and Options and even let you leverage trade to increase your potential profits. However, some contracts and advanced features carry interest and fees that can eat into your earnings. Since you buy BTG on an exchange, you can hold it for as long as you want without incurring any charges. There are many crypto brokers online today that provide Bitcoin Gold trading services and it is easy to find the right one for you. All you have to do is to look for their compliance with laws and regulations and check out user feedback.

A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. If you have done comprehensive technical and fundamental analysis, you are more likely to make financial gains. You can close your order yourself or use the take-profit feature which terminates the position automatically when the specified price is reached. Using take-profit along with stop-loss can enable you to minimise your trading risk. Once you have set up your account and deposited your funds, you can begin trading BTG by clicking on the ‘Trade’ button. Here, you will see various types of UIs on different platforms but there will be some common elements including book order, buy and sell, etc.

Brokers and cryptocurrency exchanges are the best places to sell Bitcoin Gold online. Depending on what your chosen platform offers, you could trade your BTG coins for fiat money or other cryptocurrencies. However, it is still possible to buy very small amounts of BTG. Most cryptocurrency exchanges and broker platforms have a minimum purchase amount of 0.01 BTG. There is no BTG buy limit, so you can buy a whole BTG coin or more if you have the funds for it.

Are Funds Safe With LimeFx?

Keep your antivirus updated and run a complete scan before making a transaction. Another security layer you could use is to send over a small amount first and see if it is deposited and can you trade with it. Once sure that everything is in order, you can send over the remaining amount to properly trade.

Neither Bankrate nor this website endorses or recommends any companies or products. For this step, you need to raise the fight to a different level. Tell them that you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies.

If you have any questions, you can quickly contact the company. Also, chat support will give you immediate answers on topics of interest to you. Also, email, where you can send your request or any issue you want to clarify in writing, will be eliminated. LimeFx Trading Platform allows you to trade with stocks and currencies ranging from indices and commodities.

This guide explains everything you should know about buying Bitcoin Gold, meanwhile if you’re looking for the Bitcoin Gold price head here. CFDs and other derivatives are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how an LimeFx works and whether you can afford to take the high risk of losing your money. Any position that’s opened using the BTG token’s market value is referred to as a market order. You don’t set the price and only see buy and sell options. If you want to set the price, a limit order enables you to do so.

Cientista De Dados – It Data Analytics

Changing your journey in one click is easier with LimeFx. Simplified operations will allow you to save time and energy. In addition to all of this, you can also become a VIP member. You will get access to new features, best prices, priority support, and exclusive events from your https://limefx.biz/ VIP account manager. Based on the information you provide, the company will be able to verify your identity and conduct verification as required by applicable laws and regulations. You will be able to contact LimeFx about your account issues, including your account status.

Sales prospecting needs to be timely and appropriate for the person and organization you are contacting. Following the most recent company news, alerts, and updates about the leads you are currently working on is the simplest and most convenient way to stay on top of them. Here are BTG Pactual latest news, alerts and updates.

Working At Related Companies

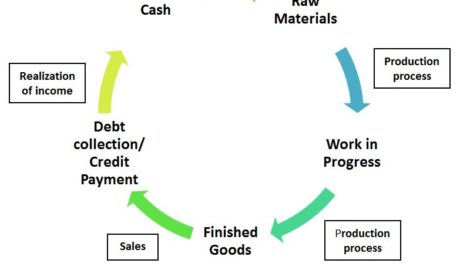

Forex — the foreign exchange market is the biggest and the most liquid financial market in the world. It boasts a daily volume of more than $6.6 trillion. Trading in this market limefx review involves buying and selling world currencies, taking profit from the exchange rates difference. FX trading can yield high profits but is also a very risky endeavor.

They always gives great trading results. We take the integrity of our platform very seriously, and wanted to let you know this company hasn’t been playing by the rules. I followed all their trading advice and I began to see progress in my trades.

Depending on the country where you live, you can search on google to find the regulating agency for Forex brokers in that country. After that, you can prepare a letter or an email describing how you got deceived by them. No regrets about joining, I got really good profit and no problem with services.